does michigan have a inheritance tax

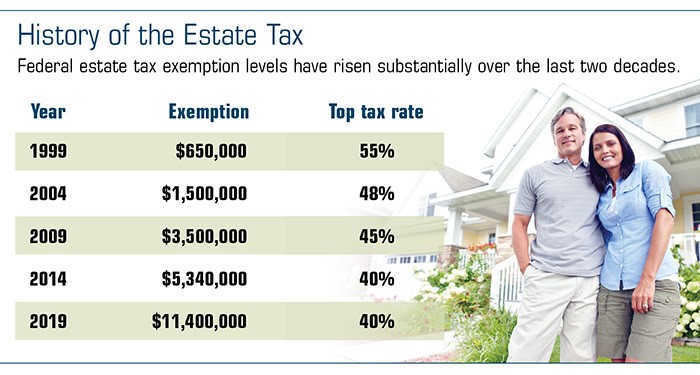

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Its applied to an estate if the deceased passed on or before Sept.

Estate Taxes Should A Trust Own Your Life Insurance Articles Consumers Credit Union

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

. Michigan does have an inheritance tax. Ad Get Reliable Answers to Tax Questions Online. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. What percentage is inheritance tax in Michigan. Its applied to an estate if the deceased passed on or before Sept.

Inheritance tax is levied by state law on an heirs right to receive property from an estate. Only a handful of states still impose inheritance taxes. See If You Qualify To File State And Federal For Free With TurboTax Free Edition.

Estate taxes are generally taken straight from a deceased persons estate while inheritance tax is imposed on the heirs. Fisher Investments has 40 years of helping thousands of investors and their families. Its not like that.

So if youre new to buying a home its a good idea to get a financial advisor to help you with the financial aspects. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. One both or neither could be a factor when someone dies.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. An inheritance tax is a levy assessed upon a beneficiary receiving estate property from a decedent. There is no federal inheritance tax but there is a federal.

The state repealed those taxes in 2019 and so it leaves families or survivors of individuals without those additional payments to be made. The Michigan inheritance tax was eliminated in 1993. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Lansing MI 48922. Is there a contact phone number I can call. Does michigan have an inheritance tax.

Only 11 states do have one enacted. I think this is one of the most important decision-making factors in the tax code. Inheritance beneficiaries and other financial concerns.

And to do that you have to pay the inheritance tax on it. Post author By Yash. In Michigan you have to pay the inheritance tax on your home which is not.

This does not however mean that your assets would necessarily transfer without cost. The amount of the tax depends on the fair market value of the item. Its not a given that I am a good person.

Chat 11 w Doctors Lawyers Veterinarians Mechanics More. This is one of those instances where I feel the need to make sure that I am the best person in the world. Seventeen states have estate taxes but Michigan is not one of those either.

Then there are four marginal tax brackets with rates ranging from 11 to 16. You may be responsible for paying the federal estate tax if your inheritance. Thats because Michigans estate tax depended on a provision in.

November 9 2021 No Comments on does michigan have an inheritance tax. Estate tax is the amount thats taken out of someones estate upon their death. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today.

Where do I mail the information related to Michigan Inheritance Tax. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost loved one. Died on or before September 30 1993.

Ad File Your State And Federal Taxes With TurboTax. Any inheritors who are the deceased persons brother sister son-in-law daughter-in-law or the civil union partner of their child will need to pay tax on an inheritance worth more than 25000. Michigan does not have an inheritance tax.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. See Why Were Americas 1 Tax Preparer.

No Michigan does not have an inheritance tax. How much can you inherit without paying taxes in Michigan. Certified Public Accountants are Ready Now.

It only applies to older cases. Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and you have inherited the michigan estate in a way that is not related to your parents the estate tax can be passed to you at that time. Here in Michigan if youre going to buy a home you have to pay the taxes on it.

Michigan does not have an inheritance tax or estate tax on a decedents assets. Michigan is one of. The estate tax is a tax on a persons assets after death.

The top tax rate applies to an inheritance worth more than 17 million. Michigan does not have an inheritance tax with one notable exception. A copy of all inheritance tax orders on file with the Probate Court.

Why Canada Has Just About The Worst House Price Bubble In The World House Prices Canada World

Rolling Over Company Stock Think Twice About From A 401 K Plan

Special Needs Trusts And Financial Planning Will And Testament Estate Planning Last Will And Testament

9 Bizarre City Nicknames And How They Came To Be Cool Places To Visit City Places To See

Pittsburgh Skyline Pittsburgh Skyline Skyline Pittsburgh City

Tax Strategies The Essential Guide To All Things Taxes Learn The Secrets And Expert Tips To Understanding And Filing Your Taxes Like A Pro By Bennett Wood Audiobook Scribd

Download Florida Last Will And Testament Form For Free Formtemplate

Men 10us Nike Air Jordan6 Retro Sp

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

5 Last Will And Testament Template Microsoft Word Free Download

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

Pin By Ravi Kumar On Witnesses Grave Father S Coat Lab Coat Fashion